Basic facts and the three sigma ruleNormal distribution is one of the most ubiquitous and most widely used in practice probability distributions that can be encountered in many places (e.g. age-specific human heights and weights have approximately normal distribution) as well as in the society (e.g. IQ tests results have approximately normal distribution). Contrary to popular belief, generally moves in prices of assets are not characterized by the normal distribution. A probability distribution is a mathematical form of describing a random process (e.g. a company's share price change over time, or the number you get rolling dice). It can be characterized by two values: - Mean (also called Expected Value) - which tells us what value is taken on average (e.g. particular share's mean change could be 0.9% which would mean that - on average - it goes up by 0.9%; it could as well go down by 3% or up by 2% or not change in value, but that tells us what happens on average)

- Standard Deviation - is a way of measuring volatility that is often used to describe the risk associated with any investment. It tells us by what value observations deviate on average from the mean. The higher the standard deviation the greater the volatility.

To better illustrate this notion in the context of normal distribution, let us first introduce one of the most fundamental properties of this distribution - the three sigma rule (from a Greek letter sigma used to denote standard deviation), also known as the "68-95-99.7% rule", which states that in the case of normal distribution 68% of the values fall within one standard deviation from the mean, 95% values fall within two standard deviations from the mean, and finally that 99.7% values fall within three standard deviations from the mean, that is almost all values are no more than three standard deviations away from the mean. This means that almost all values are clustered pretty tightly around the mean value when we deal with the normal distribution. Imagine what a valuable information that is if one knows that, for instance, a particular stock's price change follows normal distribution - it would allow us to estimate that stock's volatility (risk) with great accuracy. Normal distribution's graph is a famous bell-shaped curve with a single peak - its mean. It is symmetrical, which means that the probabilities of occurrence of two values equidistant from the mean, but on its different sides, are the same. A sample normal distribution's graph is presented below:

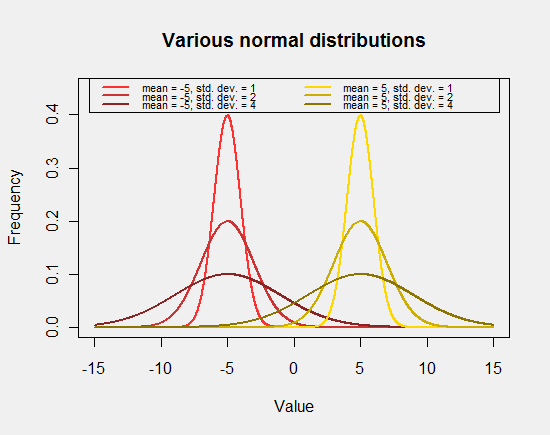

Here we can see the three sigma rule in action - most values are between -1 and 1 which is one standard deviation from the mean, almost all of them are no farther than two standard deviations from the mean, and there are virtually no observations farther than three standard deviations from the mean. Now we can fully illustrate the concept of volatility and standard deviation. Let us consider stocks of two companies, and assume that their price changes follow a normal distribution. Let us then assume that they have the same mean price change, say 0.9%. Let one's standard deviation be 0.5% and the other's - 3%. Thanks to the three sigma rule, we can then infer that in the first case 68% of the time the rate of return will be between 0.4% and 1.4%, 95% of the time the rate of return will be between -0.1 and 1.9% and almost 100% of the time the rate of return will be between -0.6% and 2.4%. In the second case 68% of the time the rate of return will be between -2.1% and 3.9%, 95% of the time the rate of return will be between -5.1 and 6.9% and almost 100% of the time the rate of return will be between -8.1% and 9.9%. This shows the great difference between the volatilities (and hence the risk associated with each one of them) of two stocks with the same mean and different standard deviations. The influence of mean and standard deviation on the properties of normal distribution.In the chart below we can see the differences between normal distributions with different means and standard deviations:

We can see that changing only the mean (leaving standard deviation unchanged) moves the graph along the x axis - the distributions with mean equal to 5 and -5 but with the same standard deviation look the same - the difference is only in the point around which the values are clustered. Changing only standard deviation (leaving the mean unchanged) influences the shape of a normal distribution's graph which means a change in volatility. The lower the standard deviation the more the values are "squeezed" around the mean, and hence the less likely it is for them to change - a stock with its daily price change distributed normally and a low standard deviation would most probably change its price (on a single day) by a tiny amount, whereas a stock with a high standard deviation would be bound to change its price (on a daily basis) by a greater amount. Is normal distribution a good tool in estimating stock price volatility?For the reasons discussed above standard deviation is widely used to describe stock price volatility. It is often assumed that price change follows normal distribution (due to its pervasiveness in the world around us, as discussed in the beginning and its relative simplicity) and the three sigma rule is applied. In fact, most price moves are well described by the normal, bell-shaped curve. But in the stock market, extreme price movements are not as seldom as the bell-shaped curve would predict. The distribution of price movements seems to have the so-called "fatter tails" than the normal distribution would imply, making it more volatile and hence making the investment more risky. It shows that market crashes and sudden, relatively large changes in price are more likely than it is commonly believed. This stems from the fact that the world is so tightly interconnected and that on the market there are few entities that can exert much influence on the price, under particular circumstances. Most of the time price change can be described by the normal distribution as the effects of myriad individual investors' decisions result in a pretty narrow range of change. Yet there are times (usually with relatively high volume) when that influential entities (renowned market analysts, mutual funds, etc.) present the same attitude towards market situation and make the same decisions which pushes the market in one direction significantly (2008 plunge). Gold and normal distribution - an exampleA chart below illustrates the idea of "fatter tails" - we can see percentage gold price changes in the period between May 14 2011 - Oct 10 2011

The above histogram presents real changes in the price of gold, while the red line is the theoretical distribution of the price change, if it were normal, with the mean and standard deviation computed using the sample. We can see that near the mean, the values resemble the normal distribution quite well, yet at the edge the values are far too high to be normally distributed. It is then very important to remember that on the stock market prices are usually more volatile than the advocates of normal-distribution approach believe. That should be taken into consideration, when estimating the risk associated with particular investment using normal distribution. One should also be wary reading various "market wizards" claims that they can keep the risk under a particular level, such as 3, 5 or 10% - such claims are most likely based upon the assumption that price changes do follow a normal distribution which - as we have seen - is usually not the case when it comes to the stock market. Therefore, we would like to stress it once more: if you invest a lot of your capital in a particular trade based on calculations suggesting that the risk is low assuming normal distribution of returns, you are likely to expose yourself to the risk that is significantly higher than the normal distribution would suggest. However, the breach of the assumption of normal distribution is not that important when we compare stocks to one another. Because even if all the results were biased for the same reason, most likely the relationships between them would not be affected. When, for instance, a truly unexpected event, such as a natural disaster, takes place, it affects virtually every stock/commodity traded on a given market. The same goes for any sudden panic attack or an outburst of optimism - if it happens it usually pushes the entire market up or down. For instance, employing such assumptions in Golden StockPicker / Silver StockPicker tools (used to rank precious metals stocks) is safe in our view.

http://www.sunshineprofits.com/research/multimedia2/../articles/normal-distribution/ |